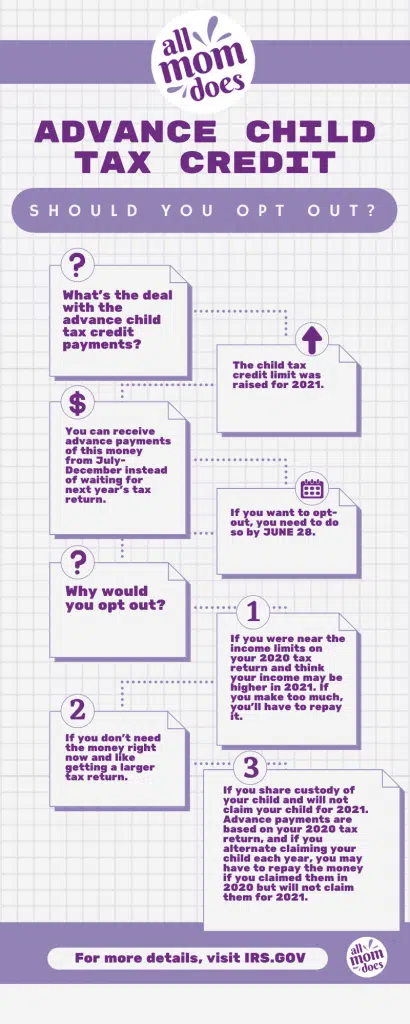

You might have heard about the Advance Child Tax Credit Payments that will be coming soon. It’s all a little confusing, so here’s what you need to know.

What Is the Advance Child Tax Credit Payment?

If you have children, you probably claim a “child tax credit” when you file your taxes each year. This is money that is deducted from the amount of taxes you have to pay. Usually, this tax credit is $2,000 per child. However, because of the COVID-19 pandemic, this tax credit has been increased to ease the financial burden on families. It is now $3,600 for children up to age 5, and $3,000 for children ages 6-17.

But in order to actually ease the financial burden, families need this money in their pockets now, not next year after they file their taxes and get their return. So, the government is giving families monthly advanced payments of this tax credit (each equal to 1/12 of the total tax credit) from July 2021-December 2021. Monthly payments will be between $250-$300 per child, depending on the age of the child.

If you choose to receive these payments, by the end of the year you will have received half of your 2021 child tax credit, meaning you will only be able to claim the remaining half when you file your taxes.

How Do I Sign Up For or Opt Out Of the Advance Child Tax Credit Payment?

If you filed your taxes by the May 17th deadline and appear eligible based on your 2020 information, you are automatically signed up to receive these payments. If you are not signed up (but want to be), or you want to opt out, visit the IRS website.

You may opt out at any time, but right now once you opt out, you cannot opt back in. Plans are in place to add an opt-back-in option in September, but as of right now, your decision to opt out is final. If you want to opt out, you must do so three days before the first Thursday of the month to avoid a payment that month. Deadlines are:

- June 28 (July payment)

- August 2 (August payment)

- August 30 (September payment)

- October 4 (October payment)

- November 1 (November payment)

- November 29 (December payment)

Why Would I Opt Out Of the Advance Child Tax Credit Payment?

If you need the money to meet your basic expenses the Advance Child Tax Credit Payment is a great way to access much-needed money that you normally wouldn’t get until early next year. However, there are a few cases where it may benefit you to opt out. Those are:

1. If your family’s annual income will increase this year and make you ineligible. The government is predicting your eligibility for the child tax credit based on your 2020 taxes. If you were near the upper income limit and expect your income this year may put you over the limit, you may want to opt out. Otherwise, you may be expected to repay it with your 2021 tax bill. The adjusted gross income limits are $75,000 for single filers and $150,000 for joint filers, with graduated reduced payments for incomes up to $200,000 (single filer) and $400,000 (joint filer).

2. If you typically have taxes due at tax time. The child tax credit reduces the amount you pay. For many people who have taxes withheld, they overpay and end up getting money back. If you usually have to pay out-of-pocket at the end of the year, taking this advance tax credit may increase the amount you owe.

3. If you don’t need the money and enjoy a large refund each year as a type of automatic forced savings plan, you may want to opt out and just enjoy a larger refund next spring.

4. If you share custody of a child and alternate which parent claims the child each year, you may want to opt out. As mentioned before, the government is predicting your eligibility based on your 2020 taxes but will determine your final eligibility on your 2021 taxes. This means that if you claimed a child as a dependent on your 2020 taxes you will automatically receive the Advance Child Tax Credit Payment now, but if their other parent is the one who claims them on their 2021 taxes, they’ll be the one who is actually eligible and you’ll be forced to repay the money.

NOTE: If you file your taxes jointly with a spouse, BOTH must opt out. If only one parent of a two-parent household opts out, you will automatically receive a half payment for each eligible dependent.

QUESTIONS? Check out IRS.gov for Frequently Asked Questions and information on how to opt in or opt out.

PIN THIS AND SHARE THIS!