I placed another two dollars into the box in my room that held my daughter’s birthday money and thought- what’s my plan for this?

The amounts that come in during birthdays and holidays from family and friends for my kids are small – a dollar here, five dollars there. And I usually imagine that I’ll use the money to buy something for them, but what always ends up happening is that I just use my debit card and the kids’ cash remains in my drawer.

What do you do with the bills and coins your kids have received as gifts for birthdays, Christmas, and other celebrations? Last week, I came up with the perfect solution to the disorganized mess that lives in a box in my drawer: the Early Saver Account through BECU. I saw an ad online for it while making an electronic transfer in my own BECU account. I could open savings accounts for my kids that were linked with my own for easy management, and while other bank accounts may require a minimum balance, the Early Saver Account requires just $5* to open!!!! So even if I only have $2 at a time, there is no penalty or other craziness. Plus, kids under 18 get 6.17% Annual Percentage Yield for the first $500!!!

It sounded like a great way to get my kids started on the right foot, but it got even better when I actually went to my local branch to open the accounts. It was a Friday afternoon. Clearly I had gone a little insane because I decided to pick up my 2- and 5-year-old from daycare and take them with me to open their accounts. Now, I don’t know about your kids, but mine are not exactly at their finest after a long week. I remembered this as we walked through the doors and my toddler went into melt-down mode almost immediately.

To make matters worse, I was not prepared. No toys, no snacks. Obviously I’m not at my finest after a long week either, given this mommy-fail. There was a small line and as I typed in my name to get into their electronic wait list, I thought, this was a mistake.

But then…

An employee walked up and said three magical words, ‘we have toys.‘

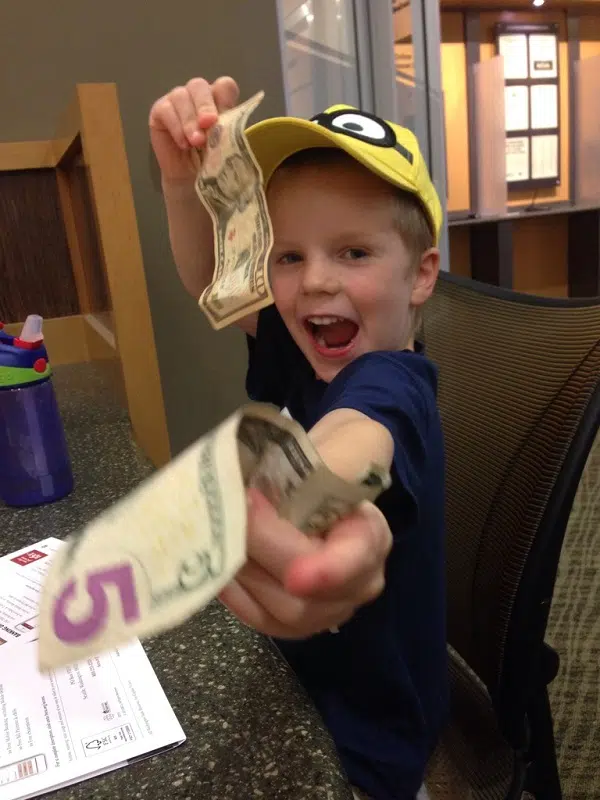

My kids forgot about their meltdowns, lit up, and dashed over to the wall of toys.

SAVED!

Two minutes later, they called my name and the woman helping me engaged my kids despite their challenging end-of-the-week emotional states. She didn’t blink an eye when they were screeching or when they were playing with toys on her desk.

A short fifteen minutes later, we were out of there, two savings accounts richer! (Tip: you will need each kid’s birthdate and social security number.)

Each kid has just $5 in each of their accounts, but I feel so great knowing that I have a plan of what to do with cash gifts they receive (and, let’s be honest, the bribe money I sometimes give them). I also feel great that I am investing in their futures, one small bill at a time!

Have you opened an Early Saver Account? Since I’m new at having kid accounts, any tips you can share?

* APY effective 8/01/2015. Rates subject to change, minimum $5 balance required in Early Saver Account. Balances over $500.01 receive a rate of .10% APY.